And if you thought that was easy, try using the StocksToTrade software. I was sick of using so many websites to find the information I needed. StocksToTrade has everything you need in one place, even ratios. But 99% of these companies likely won’t even exist in a few years.

Get in Touch With a Financial Advisor

- The current ratio is a rough indicator of the degree of safety with which short-term credit may be extended to the business.

- For instance, the liquidity positions of companies X and Y are shown below.

- These are future expenses that have been paid in advance that haven’t yet been used up or expired.

- Instead, we should closely observe this ratio over some time – whether the ratio is showing a steady increase or a decrease.

- It could be a sign that the company is taking on too much debt or that its cash balance is being depleted, either of which could be a solvency issue if the trend worsens.

You can easily calculate the current ratio by dividing a company’s current assets by its current liabilities. Since the current ratio compares a company’s current assets to its current liabilities, the required inputs can be found on the balance sheet. Investors can use this type of liquidity ratio to make comparisons with a company’s peers and competitors.

Company

For example, a company may have a very high current ratio, but its accounts receivable may be very aged, perhaps because its customers pay slowly, which may be hidden in the current ratio. Some of the accounts receivable may even need to be written off. Analysts also must consider the quality of a company’s other assets vs. its obligations. If the inventory is unable to be sold, the current ratio may still look acceptable at one point in time, even though the company may be headed for default. The current ratio is a fundamental financial metric that provides valuable insights into a company’s short-term financial health.

Free Course: Understanding Financial Statements

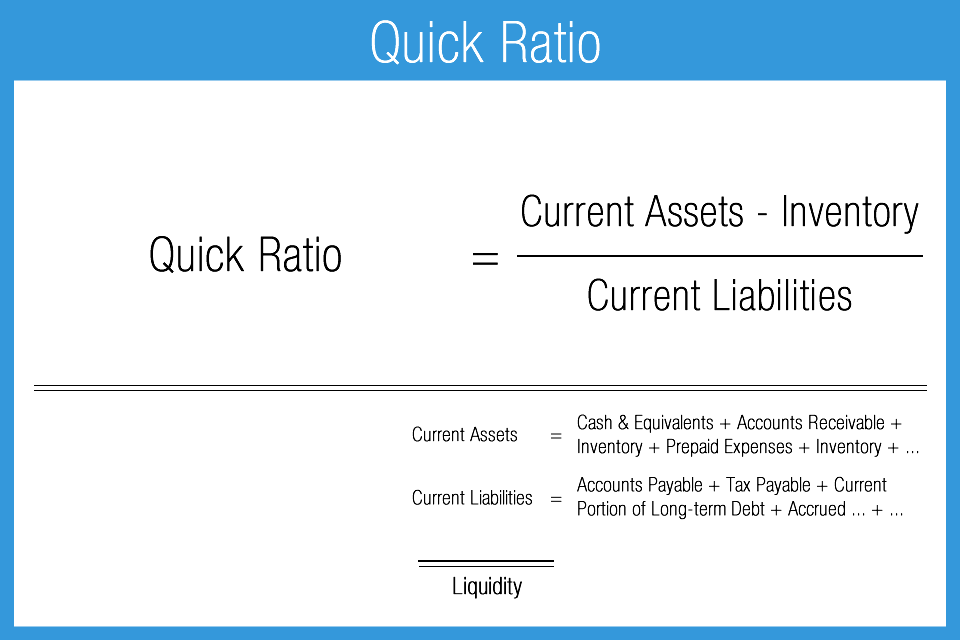

Current assets refer to cash and other resources that can be converted into cash in the short-term (within 1 year or the company’s normal operating cycle, whichever is longer). In this case, current liabilities are expressed as 1 and current assets are expressed as whatever proportionate figure they come to. Another practical measure of a company’s liquidity is the quick ratio, otherwise known as the “acid-test” ratio.

If so, we could expect a considerable drawdown in future earnings reports (check the maximum drawdown calculator for more details). The simple intuition that stands behind the current ratio is that the company’s ability to fulfill its obligations depends on the value of its current assets. While a high Current Ratio is generally positive, an excessively high ratio may indicate underutilized assets. It’s essential to consider industry norms and the company’s specific circumstances. For example, in some industries, like technology, companies may maintain lower Current Ratios as their assets are less liquid but still maintain financial health.

Current Ratio vs. Quick Ratio: What is the Difference?

GAAP requires that companies separate current and long-term assets and liabilities on the balance sheet. This split allows investors and creditors to calculate important ratios like the current ratio. On how to add xero data to a business dashboard U.S. financial statements, current accounts are always reported before long-term accounts. This means that a company has a limited amount of time in order to raise the funds to pay for these liabilities.

To assess this ability, the current ratio compares the current total assets of a company to its current total liabilities. Current ratio analysis can give you a quick view of a company’s liquidity using all the current assets and current liabilities. Current ratio is a number which simply tells us the quantity of current assets a business holds in relation to the quantity of current liabilities it is obliged to pay in near future. Since it reveals nothing in respect of the assets’ quality, it is often regarded as crued ratio. On December 31, 2016, the balance sheet of Marshal company shows the total current assets of $1,100,000 and the total current liabilities of $400,000.

Because inventory levels vary widely across industries, in theory, this ratio should give us a better reading of a company’s liquidity than the current ratio. A high current ratio, on the other hand, may indicate inefficient use of assets, or a company that’s hanging on to excess cash instead of reinvesting it in growing the business. A current ratio that is in line with the industry average or slightly higher is generally considered acceptable.

Many entities have varying trading activities throughout the year due to the nature of industry they belong. The current ratio of such entities significantly alters as the volume and frequency of their trade move up and down. In short, these entities exhibit different current ratio number in different parts of the year which puts both usability and reliability of the ratio in question. A higher current ratio indicates strong solvency position of the entity in question and is, therefore, considered better.